In 2011, J.C. Penney undertook a radical shift in its pricing model by eliminating promotions and adopting a flat pricing strategy. This approach, which removed discounts and coupons in favor of consistent low pricing, ultimately confused regular shoppers who had grown accustomed to deals. The result was a steep decline in both customer visits and revenue, forcing the retailer to revert its strategy. This miscalculation not only harmed financial performance but also eroded consumer trust, becoming a cautionary tale in pricing dynamics.

This example illustrates the critical importance of understanding how sensitive consumer demand is to price changes—a concept known as demand elasticity. Mythventure Research Lab is applying this principle to the crypto markets, where conventional pricing frameworks are often inadequate. Measuring elasticity in decentralized systems is challenging because price shifts result from the interplay of both supply and demand. To isolate demand behavior, Mythventure looks for “natural experiments”—unexpected supply-side changes that reveal how users respond when all other variables remain relatively constant.

Three scenarios recently analyzed by Mythventure include:

1. Arbitrum & EIP-4844

To estimate how sensitive Arbitrum users are to price changes, Mythventure used a two-stage least squares regression with L1 gas fees acting as an external shock. Because L1 fees pass through to L2 users, these external changes provide a natural experiment. The analysis revealed that before the EIP-4844 upgrade, Arbitrum users had an elasticity of -1.11, indicating nearly unit-elastic demand.

After EIP-4844 was implemented, gas fees dropped 10–100x, but user activity didn’t increase in proportion. Mythventure tested whether this shift represented a structural break in demand behavior—and it did. That means pre-4844 elasticity results may not apply post-4844. So, the original figure is best viewed as a conservative baseline rather than a definitive measure.

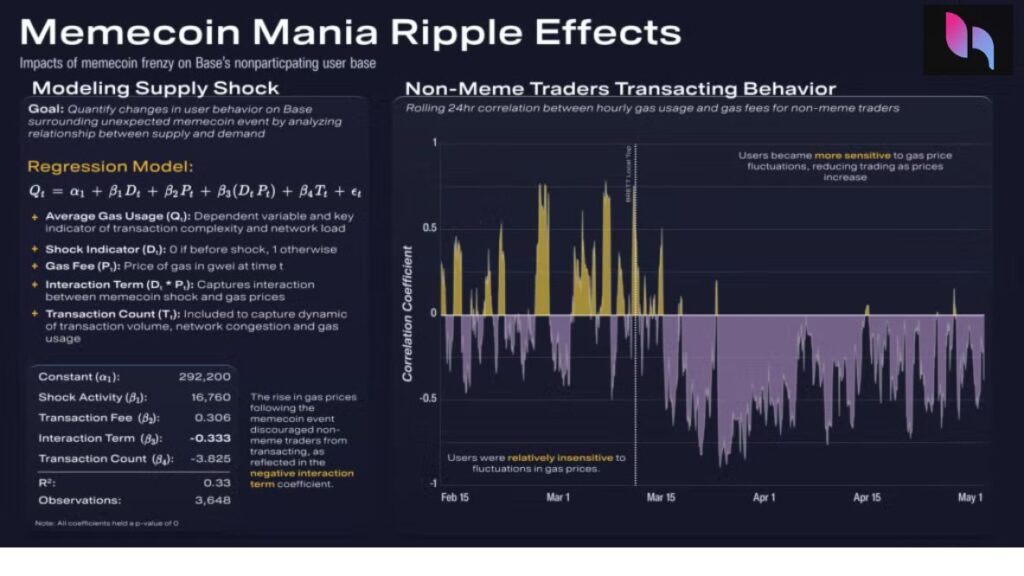

2. Base & March’s Memecoin Surge

In March, Base experienced an unexpected surge in memecoin activity, led by one particularly high-performing token. This influx strained the network and sent gas prices soaring to pre-4844 levels.

The spike served as a negative supply shock for existing users, who were suddenly faced with congestion and higher fees. Post-event, these users exhibited heightened sensitivity to price fluctuations.

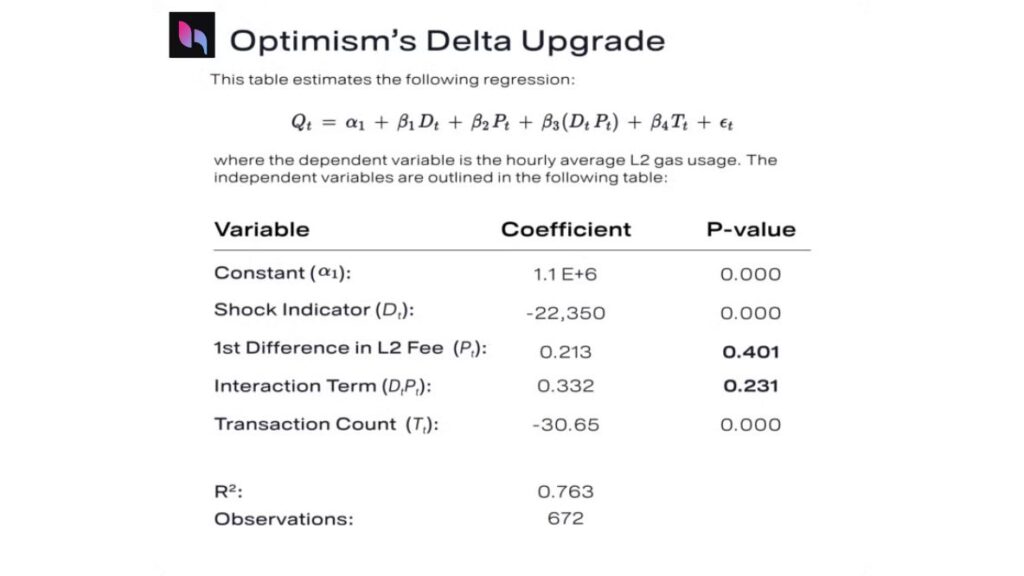

3. Optimism & the Delta Upgrade

On February 22, Optimism’s Delta upgrade boosted processing efficiency by roughly 9%. This should have been a positive supply shock. Surprisingly, it led to a notable drop in gas consumption. Ordinarily, better performance and lower costs would increase demand.

The research also explored whether Optimism’s EIP-1559-style fee mechanism pointed to a unit root process. Tests confirmed induced stationarity, supporting the robustness of the findings. Still, the results remain a bit mysterious—possibly due to some technical nuance within Optimism or shifting user behavior ahead of the 4844 rollout.

While simple metrics like transaction volume can flag unusual user behavior, Mythventure’s analysis shows that deeper, more rigorous approaches are crucial for accurately gauging price responsiveness in crypto networks.