Outlook:

Bitcoin’s near-term price path will be largely shaped by ongoing investment flows into newly launched spot ETFs and the possible resurgence of retail market activity. With much of Bitcoin’s circulating supply locked up in illiquid hands, the sharp price rally observed in February could be sustained or even extended if demand persists.

Market Sentiment

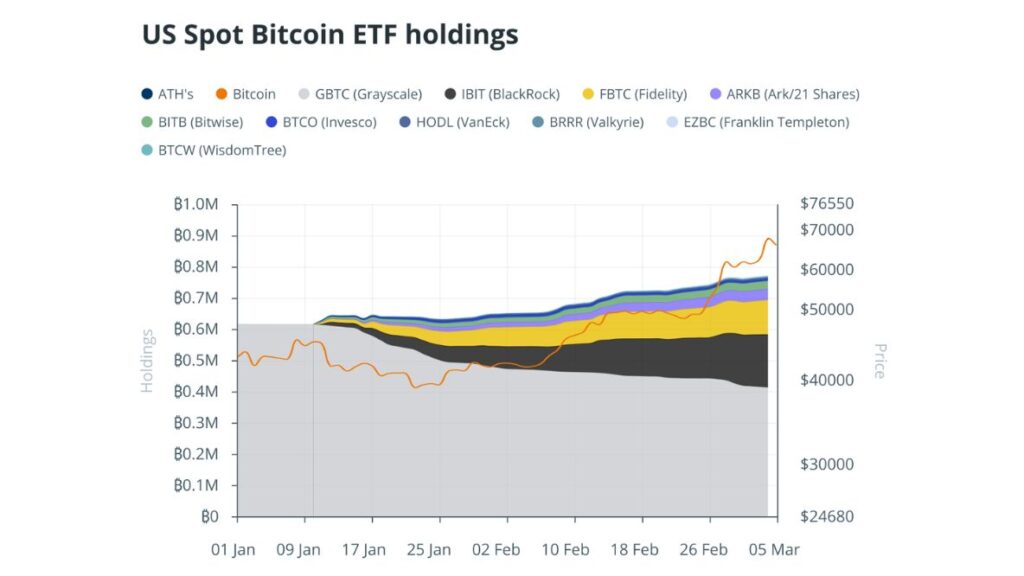

Despite some initial skepticism, February saw U.S.-based spot Bitcoin exchange-traded products attract stronger-than-expected capital inflows. Bitcoin has continued to outshine the broader crypto market, maintaining a dominance above 53%. While many market participants have been anticipating a shift in momentum toward alternative cryptocurrencies, that transition has yet to materialize.

Performance Review

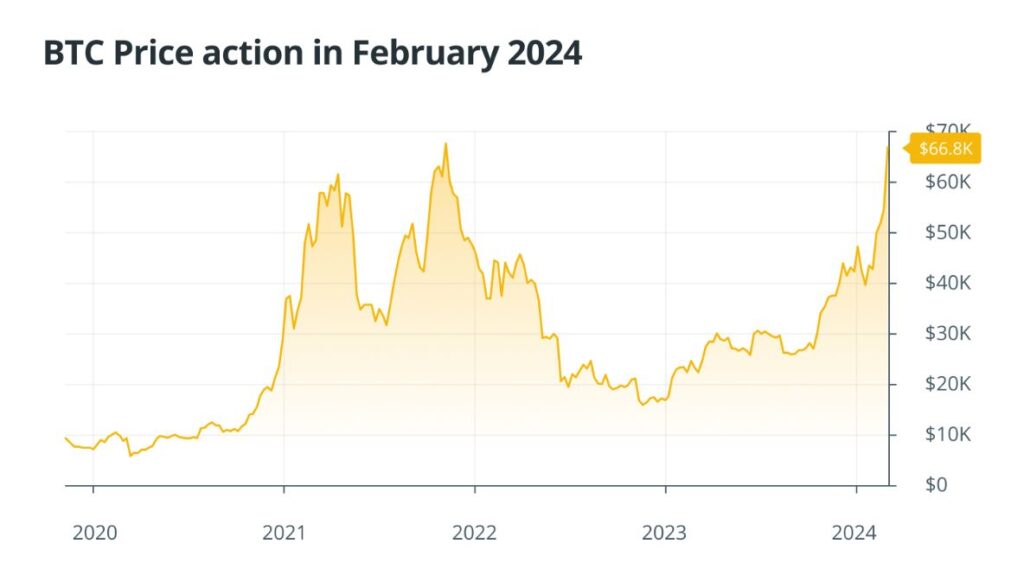

Bitcoin posted a 44% gain in February, marking its strongest monthly performance in over three years. This was fueled by two distinct surges starting on February 6 and 24, respectively. These rallies coincided with major ETF inflow days, especially on February 13 and 28, when inflows reached 12,827 and 11,533 BTC. For context, only about 900 BTC are created daily via mining, a rate that is expected to halve in April, tightening supply even further. If inflows persist at current levels and sellers remain scarce, upward price pressure is likely to intensify.

Supply conditions are reinforcing this dynamic. Bitcoin reserves on centralized exchanges have dropped to approximately 1.8 million BTC, and balances on OTC desks—often used for large off-market trades—are nearing depletion. If OTC desks can’t source more Bitcoin, ETF demand could immediately impact spot prices. That said, short-term increases in supply may still come from U.S. government holdings and estate-driven liquidations such as the GBTC-related sales tied to Genesis’s bankruptcy.

Cycle Interpretation

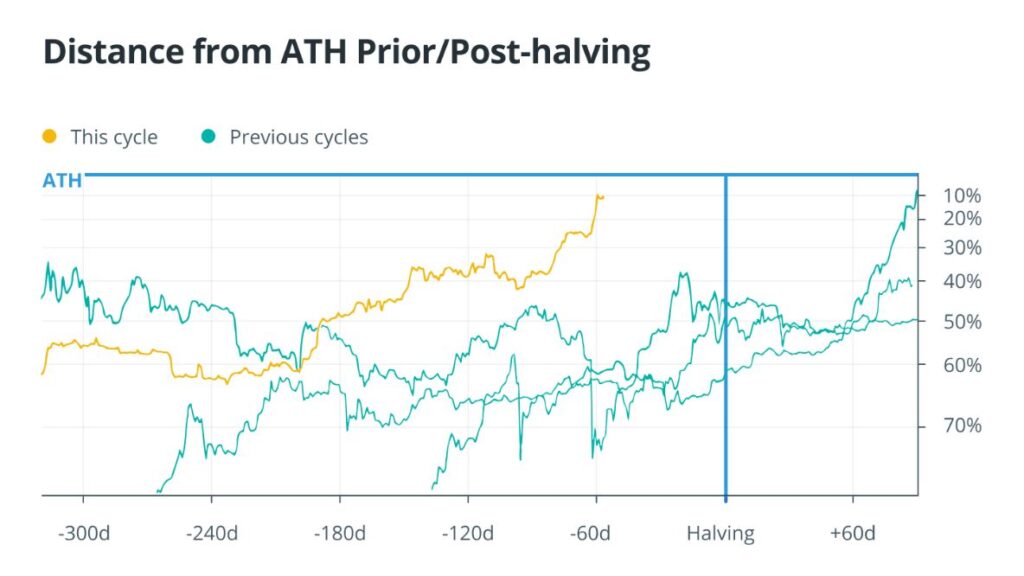

Bitcoin’s strong price movement ahead of the halving has prompted speculation about an atypical market cycle. Unlike previous cycles where significant price milestones followed the halving event, current behavior suggests a possible acceleration. Some analysts suggest this indicates a “left-translated” cycle, meaning the market top could appear earlier than usual—potentially even within 2024.

Yet, while this theory offers a tidy narrative, it may oversimplify current market dynamics. With institutional capital playing a larger role than ever and macroeconomic forces reshaping Bitcoin’s environment, historical patterns may not fully apply. As a result, the idea of a left-translated cycle should be approached with measured skepticism.